Eastfield Resources Ltd.’s Corporate Strategy has four key points:

- Project Venturing - Projects are acquired at an early stage and are optioned to third parties to provide exploration funding. This adds leverage allowing the company to pursue several projects at once, resulting in reduced overall risk and increased chance for discovery.

- Metals and Deposit Targeting – Eastfield confines its exploration efforts to large deposit types, containing metals with strong supply/demand relationships and is committed to adding additional high-quality properties to its portfolio.

- Political and Economic Stability – Eastfield prefers to work in areas that allow cost-efficient exploration, with secure mineral tenure and progressive mining law. Eastfield believes B.C. is a reliable jurisdiction with a deep pool of exploration proffesionals, a wealth of supporting services, exceptional infrastructure with access to Pacific markets and strong demand for high quality exploration projects. Currently all of Eastfield's properties are located in British Columbia, Canada.

- Fiscally Responsible – Eastfield’s management is committed to tight administrative cost controls. Low overhead, combined with cash flow from property option payments, reduces the need for equity financings and share dilution.

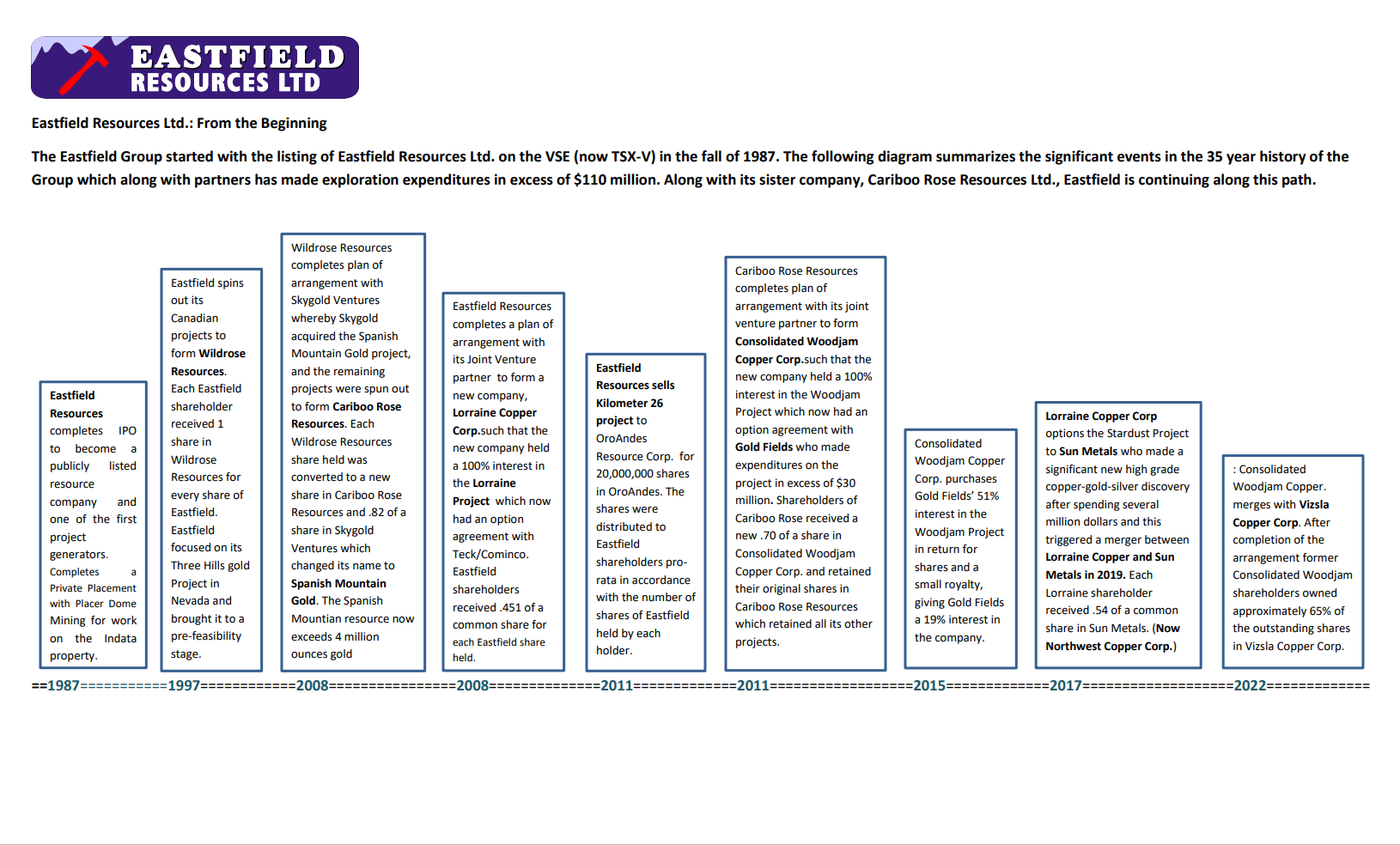

Eastfield has generated the majority of it's its cash flow internally without the need for regular dilutive financings. Over time, this strategy has also resulted in the spinout of 5 companies to the benefit of Eastfield shareholders, and the accumulation of several million shares in companies including Northwest Copper Corp., Consolidated Woodjam (Now Vizsla Copper, Alpha Copper Corp and others..